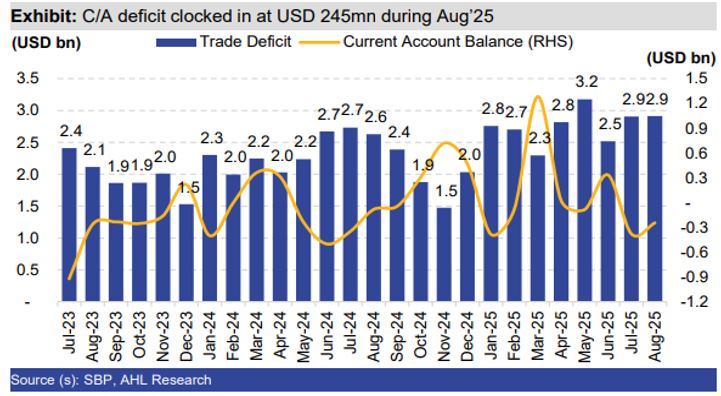

Pakistan’s external sector remains under severe pressure as the current account deficit (CAD) for August 2025 reached 245 million US dollars, showing a marginal improvement from July’s 379 million US dollars, but remaining far above last year’s 82 million US dollars in August. The cumulative CAD for July and August FY26 reached 624 million US dollars, rising sharply from 430 million US dollars in the same period of FY25.

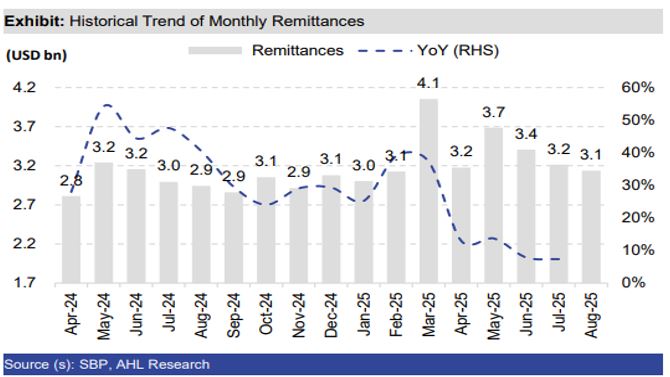

Last fiscal year ended with a surprising surplus of 2.113 billion US dollars, largely supported by record remittance inflows, which helped stabilize the exchange rate and bolster foreign currency reserves. However, FY26 has witnessed a marked slowdown in remittances, growing only 7 percent in the first two months compared to 44 percent last year, adding pressure on Pakistan’s external accounts amid rising food imports and mounting inflationary pressures.

Structural Factors Behind Pakistan’s Trade Deficit

The widening trade deficit in Pakistan is driven by multiple structural and cyclical factors. A key contributor is the country’s heavy reliance on imports, especially energy, machinery, and raw materials. This dependency is partly due to the limited diversification and low competitiveness of Pakistan’s industrial base, forcing the economy to rely on imported capital goods and intermediate inputs critical for domestic production.

On the export side, Pakistan’s portfolio remains narrow, concentrated in textiles, agricultural products, and other low value-added sectors, with minimal penetration into global value chains. Most exported goods have low-income elasticity and high price elasticity, meaning demand remains stagnant even during global economic expansion and is highly sensitive to price changes.

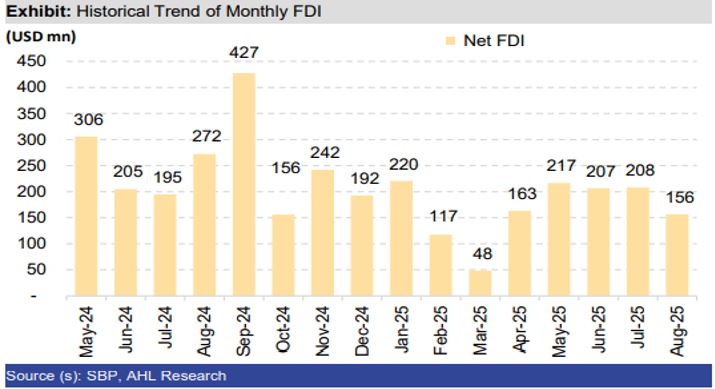

Additionally, low foreign direct investment (FDI) and limited investment in export-oriented industries suppress domestic capacity to produce competitive goods and expand the export basket. Structural inefficiencies—high production costs, poor infrastructure, bureaucratic hurdles, and inconsistent policies—further undermine export competitiveness and perpetuate import dependence.

Pakistan’s economy also remains largely import-led, where domestic consumption and production are heavily reliant on imported goods, which inherently drives up the trade deficit.

Currency Depreciation, Its Double-Edged Impact

Currency depreciation, in theory, should benefit exports by improving price competitiveness. However, for Pakistan, it has largely increased the cost of imports, which constitute a large share of consumer and industrial demand. Rising import costs contribute to inflation, especially for essential commodities such as wheat, sugar, fuel, and other staples.

The interaction between depreciation, import dependence, and weak export growth amplifies inflationary pressures. Rising consumer prices reduce purchasing power, worsen economic inequality, and increase the cost of living. Cost-push inflation can dampen domestic demand, erode real incomes, and slow down investment, ultimately suppressing GDP growth.

Empirical Evidence, Macroeconomic Consequences

Empirical studies from Pakistan confirm that increasing inflation and money supply negatively impact the trade balance by boosting import demand, while currency depreciation produces mixed outcomes—beneficial for exports but costly for imports. A larger current account deficit also strains fiscal resources, as more foreign currency is needed to finance the gap, potentially increasing sovereign debt and crowding out productive government expenditure.

Persistent deficits undermine investor confidence, reduce economic growth, and heighten macroeconomic instability. The slowdown in remittances, which had previously cushioned foreign exchange reserves, leaves Pakistan more exposed to balance of payments crises, exchange rate shocks, and volatile capital flows.

Policy Measures for External Sector Stabilization

Addressing Pakistan’s external sector challenges requires a multi-pronged strategy focusing on export growth, import rationalization, and macroeconomic stability:

- Broadening the export base: Pakistan must move beyond traditional sectors and focus on value-added manufacturing, including ready-made garments, engineering goods, pharmaceuticals, and agro-processing. These sectors have higher global demand and income elasticity.

- Export promotion: Implementing policies such as incentives, infrastructure improvements, research and development support, and innovation programs can boost competitiveness.

- Improving the business environment: Simplifying regulations, reducing bureaucratic hurdles, strengthening intellectual property rights, and attracting foreign direct investment can foster technology transfer and capital inflows critical for export-oriented industries.

- Import rationalization: Targeted tariff and non-tariff measures to limit non-essential and luxury imports, along with encouraging import substitution in strategic sectors, can reduce reliance on foreign goods while supporting domestic production.

- Exchange rate management: Maintaining a market-driven but stable currency is vital to balance export promotion with inflation control. Excessive volatility harms both trade competitiveness and consumer purchasing power.

- Coordinated monetary and fiscal policies: Controlling inflation, managing excess liquidity, and reducing fiscal imbalances will improve the trade balance and stabilize the economy.

Conclusion: A Call for Comprehensive Reform

Pakistan’s trade deficit, driven by import dependence, narrow export diversification, and low foreign investment, remains a serious challenge. Consequences—including exchange rate volatility, inflationary pressures, fiscal strain, and subdued growth—highlight the need for urgent, comprehensive reforms.

Effective external sector reform requires coordinated actions to:

- Enhance export competitiveness

- Rationalize imports

- Stabilize macroeconomic conditions

- Leverage external financial resources

Prioritizing structural reforms, executing trade strategies, and fostering an investor-friendly environment are essential to reduce external imbalances and achieve sustainable economic growth, mitigating Pakistan’s vulnerability to future external shocks.